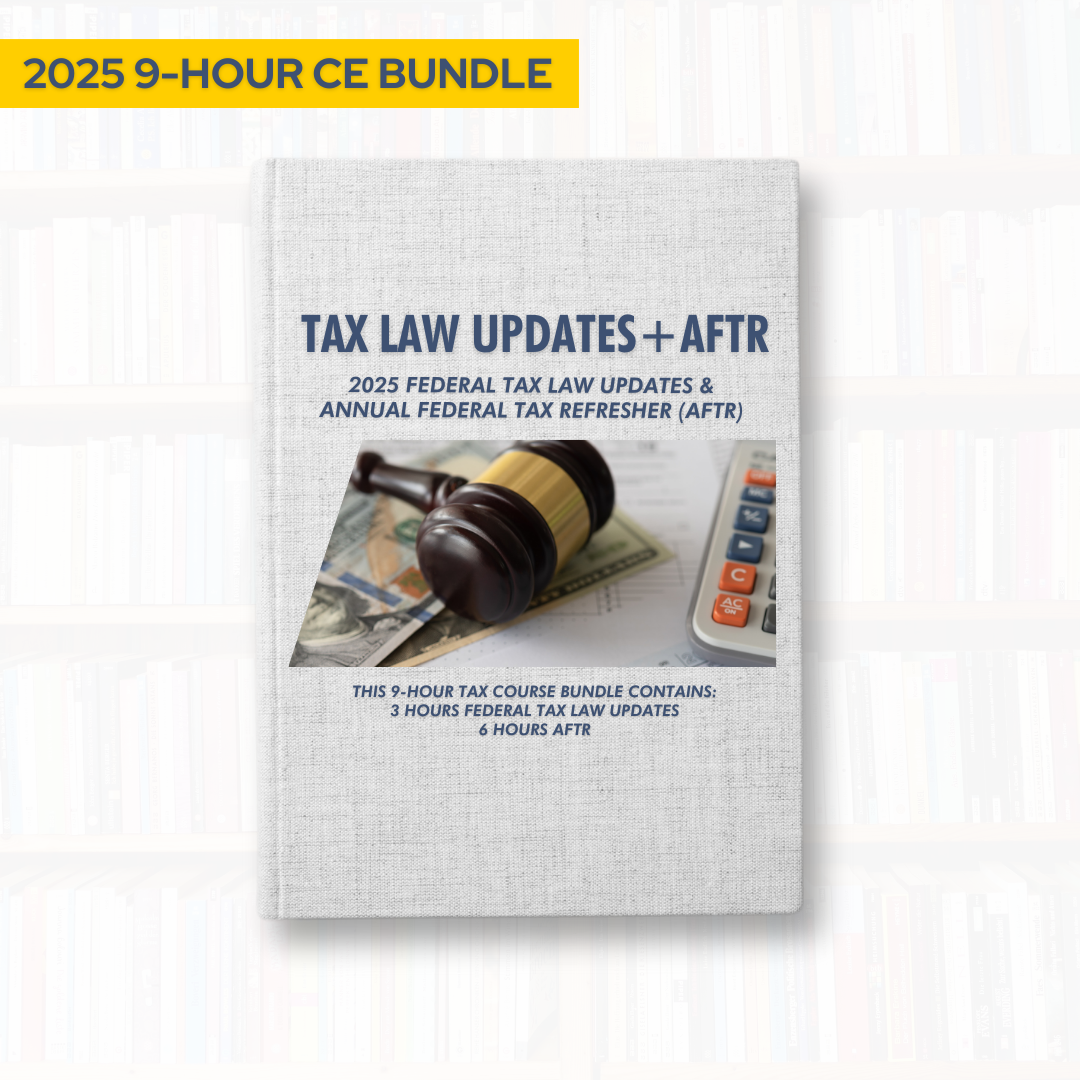

2025 9-Hour Federal Tax Law Updates and AFTR Bundle

$85.99

Learning Objectives: Gain a thorough understanding of recent changes to federal tax laws for tax season 2025 and how they...

Learning Objectives:

- Gain a thorough understanding of recent changes to federal tax laws for tax season 2025 and how they impact individual and business tax returns.

- Refresh your knowledge of various tax credits and deductions, including their eligibility requirements, limitations, and phase-out thresholds for tax season 2025.

- Understand the annual inflation adjustments made by the IRS, including changes to federal income tax brackets, the standard deduction, and personal exemption amounts.

- Utilize comprehensive charts and visuals throughout the course to illustrate complex tax concepts and legislative changes.

Our 9-hour tax course bundle contains 3-hour federal tax law updates and 6-hour AFTR.

Course included

| Course name | Duration | Level | Price |

|---|---|---|---|

| 2025 Federal Tax Law Updates | All levels | $36.00 | |

| 2025 Annual Federal Tax Refresher (AFTR) | All levels | $49.99 |